Current Portfolio - The Fed is Failing

With 5y5y inflation expectations breaking out to new highs, the Fed's preferred scorecard shows they aren't taking the inflation breakout seriously enough. Keep selling stocks and bonds until they do.

In my post from March 9th entitled “You Had One Job,” I mentioned that the Fed’s only real job was to keep inflation expectations “well-anchored.” Back then, with their preferred metric for measuring long-term inflation expectations, USGG5Y5Y, up around 2.4%, I said they were failing miserably in their attempt to prevent inflation expectations from becoming embedded in the public narrative and that we were sellers of bonds, favored value over growth and were in favor of a pro-inflation playbook (own commodities/hard assets/bitcoin) on the long side.

So here we are now, 6 weeks later, and we can see that USGG5y5y, which is basically where the market in 5 years believes inflation will be 5 years out from then, has continued its upward trajectory and is making a new high today at near 2.6%. This is not “well-anchored.”

Source: Bloomberg Data

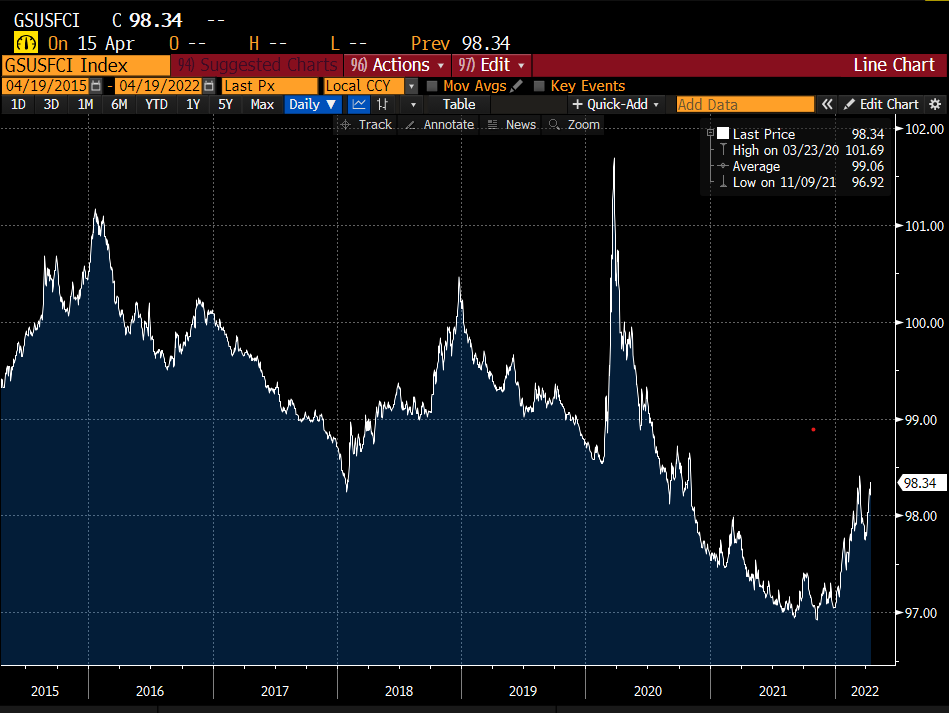

The Fed has suggested that its primary way to control inflation expectations is via the tightening of financial conditions, which we can see below have begun to tighten moderately off the loosest levels ever at the end of 20201 but are still significantly less tight today than really any period in the 5 years prior to Covid. This suggests they are still so much more the Fed should be doing if they seriously wanted to prevent inflation from running away.

Source: Bloomberg Data

With CPI currently running above 8% and limited signs that the supply chain and energy issues that have been with us for months are going away any time soon, the Fed needs to be speaking more hawkish and acting more aggressively. In order to show they are serious about preventing inflation expectations from running away and instead returning back toward their 2% target, the Fed must work harder to tighten financial conditions. Financial conditions indices are largely a function of movements in interest rates, credit spreads, the US$ and equity prices. Despite the move higher in interest rates and the US$ we have seen and the moderate tightening of credit spreads since the beginning of the year, the largest variable here that can move financial conditions tighter would be an equity market correction. We agree with former Fed governor Dudley who recently suggested that the Fed will have to engineer a further stock market correction in order to tighten financial conditions enough to bring down inflation expectations. Despite the first rate hike of 25bps last month and expectations for a series of 50bps hikes starting in May with the prospects of quantitative tightening of the Fed’s enlarged balance sheet beginning in June, the markets are still implying it is not enough and the Fed will need to do more. We will trade along side the tightening that is needed to prevent inflation expectations from running away. We don’t want to fight the Fed.

With this in mind, we have set up our portfolio accordingly as discussed last week and updated below. Feel free to reach out with questions or comments.

Macro Ideas

Long gold and gold miners via GDX (big miners start reporting this week, expect to start seeing some dividend raises and share buybacks)

Long crude calls

Long Bitcoin

Short bank ETFs

Short 30 year bonds

Short IWM/QQQ/EEM/EZU/EWZ via puts

Single Name Exposures

Long DISH (upcoming early May investor day catalyst)

Long MP/LNG/NOG/CCJ/MOS/AGRO (various long commodity related names/inflation hedges)

Long FRO/STNG (tankers which will benefit as storage plays in oil storage world)

Long DBA (agriculture commodity ETF)

Long KEUA (European carbon credit exposure)

New Ideas added last week

Long FCX (copper play, fits in commodity/hard asset theme)

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.