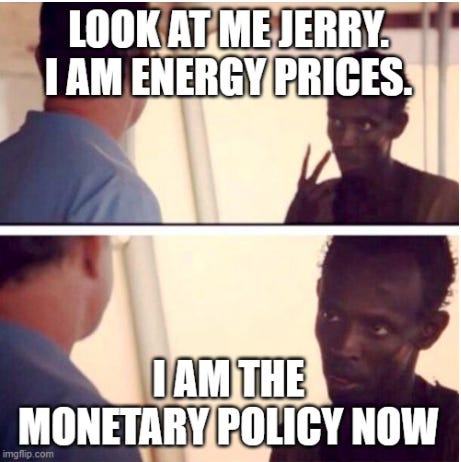

Energy is the New Monetary Policy

A country's cost of capital and FX value is driving by its proximity to upstream resources thanks to Putin. Out with the central bankers, in with the commodity analysts.

We are seeing a transition from the power of central banks to the power of commodity resource access (particularly energy and food) as the main driver of a country's cost of capital and the value of its exchange rate. Countries that are forced to import major raw goods like energy and food (think Europe and Japan, as well as various EM countries) are seeing massive imported inflation which is driving up their cost of capital and driving down the value of their exchange rate while major commodity exporters like Russia as well as largely self-sufficient nations like the US are seeing their currencies rally immensely with a more muted rise in yields. Putin has changed the game, other countries are starting to wake up (particularly in the Eastern bloc) and we are still in the early innings of this transition away from a solely US$ hegemonic regime. Central bankers are still playing catch up but bond market and FX investors are beginning to notice. As the bond market gets more concerned about country availability of resources, yields rise and central banks will be forced to tighten more aggressively to defend their own currencies but will also likely exacerbate the growth slowdown.

For now, I am focused on shorts in commodity importing regimes against longs in upstream energy and food but with the $ continuing to rally and yields inching higher, I am growing into a larger net short construct with an expectation for new lows in most risk assets in the coming weeks as high and sticky inflation exacerbates a growth slowdown which central bankers are unable to address.

Come find me over at LaDuc Trading for more insights.

Regards,

Craig

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.

https://laductrading.com/product/macro-advisor-monthly-subscription/

https://laductrading.com/product/macro-advisor-annual-subscription/

And for the first 25 subscribers that sign on and use the code MacroLAUNCH100, the pricing of $99/month for these services will be locked in for the life of the subscription.

Feel free to reach me at craig@laductrading.com if you have any questions. I am extremely excited about this new venture. I hope you will join me.

Thanks,

Craig Shapiro