In Search of a Bottom

As long as Fed remains uncertain, the market will be uncertain which means risk-off. But this down move could be running out of time over next few trading days. Black Monday? Why not

We have been harping all year that the Fed remains behind the curve in addressing elevated inflation readings and preventing inflation from becoming well-entrenched in the public psyche. We have been saying that despite the tightening of financial conditions seen thus far, inflation expectations as measured by market pricing (like USGG5y5y and breakeven yields) and survey data (UMich Inflation Survey, NY Fed Inflation Survey, etc.) still remain too high, suggesting that the Fed would need to signal even more tightening in order to be successful. While they have been trying to toe the line with their tightening agenda to achieve a soft landing in the economy, the issue they face is that by not going all-in on the tightening, they allow for risk-on/relief reaction functions by markets, which then raises inflation expectations again and pushes them further away from their goal of using financial conditions and communication tools to bring down inflation. We wrote about this last week in our piece “Powell the Volatility Dampener…But for How Long?” and mentioned that the prospect of a strong payroll print and then better than expected CPI print was likely to lead to the market calling the Fed’s bluff and re-engaging in more risk-off activity.

Yesterday’s CPI print at 0.6% core m-o-m price gains was above every street estimate and cast significant doubt on the idea that inflation has already peaked and that what the Fed has done to date will be enough to bring inflation back down toward 2%. Simply said, the Fed will have to signal even more tightening is coming and will have to deliver on more tightening of financial conditions in order to achieve this goal. We do not believe they can continue to “sugarcoat” (credit Bill Dudley) the current environment. They need to convince the market that the tightening is going to slow demand enough to bring prices down and that is the objective, particularly with the labor market currently as robust as they see it. And with the adage of “Don’t Fight the Fed” still in place, we remain positioned with a risk-off bias until they are successful.

We think the possibility of a large risk-off event in the coming few days is very possible. We discussed the idea of a Black Monday redux in a post from January, discussing the conditions that were present back then which led to a crash. We continue to see eerie similarities between then and now.

When Paul Tudor Jones discussed Black Monday and the conditions that were present ahead of it, he mentioned the following:

Range Expansion

Record Volume

Record Nominal Down Day

Close below the 200d Moving Average (not discussed specifically in this interview but was mentioned by him in his Trader documentary as part of his bear thesis then")

Overvaluation in markets for some time with the piercing of a bubble in days leading up to the selloff

Wall Street is unprepared for the magnitude of a drop

As for the fundamental conditions, high inflation readings, elevated oil prices, and a sell-off in fixed income were all part of the mix. It seems to me like we have a similar setup now.

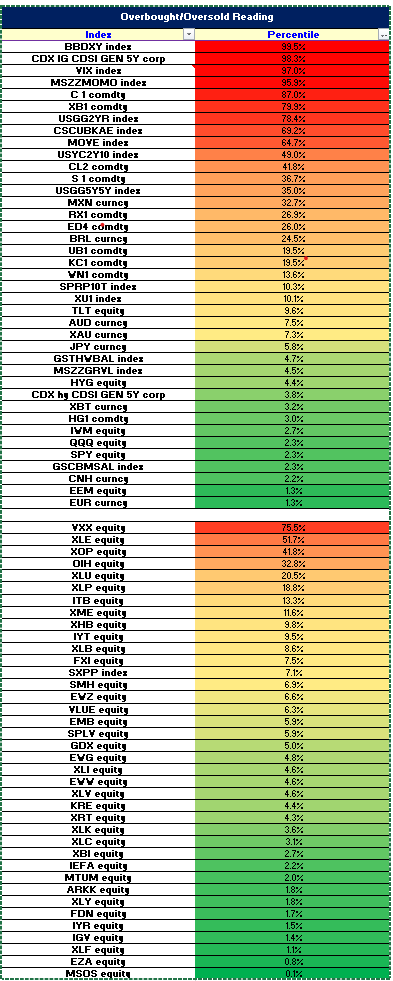

We are now looking for an acceleration of volume selling in the coming days that could lead to the capitulation event. Our technical readings are getting toward extremes but it is worth noting that historically, many big sell-offs come from very weak market conditions rather than from the highs.

The dollar move is quite extended, credit is on the wides, and the VIX is getting toward overbought while equity indices are getting toward very oversold levels. The market is nervous and rightfully so. The Fed is providing no comfort. The Fed doesn’t know when it will stop tightening, doesn’t know what the neutral rate really is, doesn’t know why financial conditions tightening thus far hasn’t really arrested inflation, says it has no control over the supply chain and hasn’t been yet able to negatively impact demand. Perhaps we are reaching a crescendo moment here where investors throw in the towel and beg the Fed was some assurance that “everything is gonna be alright”. The next few days will be telling. We are positioned very short risk here with an eye on covering next week into a capitulation bottom.

Current Positioning:

Macro Ideas

Long gold and gold miners via GDX

Long crude calls

Long Bitcoin

Short IWM/QQQ/EEM/EZU/EWZ/EWW via puts and futures

Single Name Exposures

Long MP/LNG/NOG/CCJ/MOS/AGRO/FCX (various long commodity-related names/inflation hedges)

Long FRO/STNG (tankers that will benefit as storage plays in the oil storage world)

Long DBA (agriculture commodity ETF)

Long KEUA (European carbon credit exposure)

Positions removed since Monday:

Short 30-year bonds - with likely risk-off events coming, bonds could rally. We will look to revisit shorts after the Fed signals the potential to add liquidity again.

Long DISH (upcoming early May investor day catalyst) - stopped out

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.