Portfolio Update - Looking for Signs of Capitulation to Cover Shorts into Fed meeting

$/cnh breakout was great catalyst to cut reflation bets and press the risk off book. While the Fed still has a lot of tightening to do, we'll use tactical signals to cover some shorts if we see them.

In my update from last Wednesday, I discussed that big moves in $/CNH throughout history have often led to mini-deflationary bust periods that were risk-off in nature.

That was a timely call as this muscle memory allowed me to press short bets in EM ETFs and add short exposures in large-cap miners. I have profited nicely from the moves over the last week and I still don’t think the bottom has been reached yet as the Fed continues to tighten on its journey to remove inflation expectations from the public psyche. I see significant risks to markets over the course of this year while this tightening continues. I am looking for major US averages to eventually re-test their pre-Covid highs (Nasdaq below 10k, SPX below 3500) over the course of the next few months. I remain in sell the rip mode.

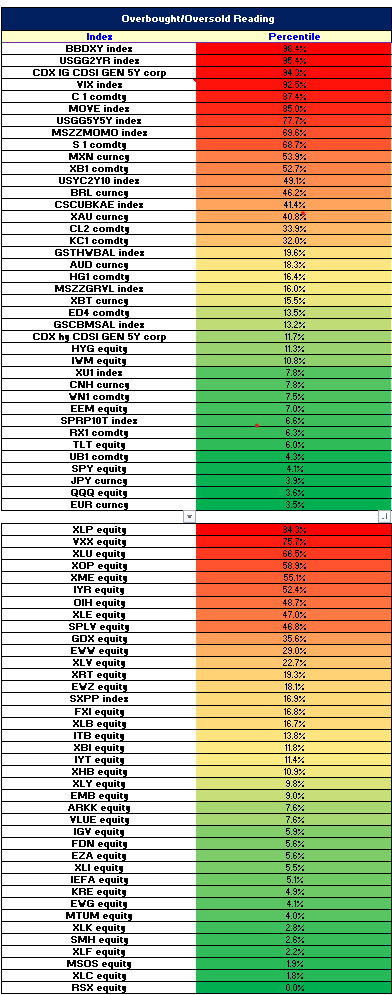

That being said, while trading, I want to use my risk management tools and technical indicators to help guide our positioning along the journey to my expected destination. While I have various tools in the toolkit, I wanted to discuss one of the major ones here. I have developed an overbought/oversold technical indicator that looks at the trailing standard deviation of performance for any particular security, ETF, stock, etc. along with its relative strength weighted equally to establish a score and compare that score to the historical scores of the security to determine the degree to which it is overbought or oversold. This helps guide me on position sizing ideas and trying to catch the inflection points. Observing the degree to which securities are overbought/oversold also helps me weave together the narrative the market is trading. Here is what the current dashboard looks like:

I can see a few things on this chart. First off, the US$ has been performing extraordinarily well and is clearly more overbought than not. So this is the first sign to me that there is potential for the $ strength to stall out in the coming days. Given stronger $ was part of the rationale for getting negative on risk assets, I will be sizing down some of these $ related ideas as this signal approaches near 100%. On the flip side, and not surprisingly, I see various currencies signaling quite overbought, especially the euro and yen. The CNH is toward the bottom of the list as well but still seems like it has room to get weaker. With respect to the Vix, it is more overbought than not but not maxed out yet. SPY and QQQ are more oversold for sure but also not at max. On the sector ETFs nothing really stands out on the overbought side but on the oversold side, the more technology-related ETFs like XLC, SMH, and XLK are very oversold.

I will continue to watch this dashboard closely. I expect to remain with the risk-off portfolio that I have shared with you at least through the May Fed meeting next week but will watch for signs of exhaustion to tactically reduce positions into the event if the moves I am expecting take place ahead of the Fed.

With this in mind, here is what the portfolio looks like now. Feel free to reach out with questions or comments.

Macro Ideas

Long gold and gold miners via GDX

Long crude calls

Long Bitcoin

Short bank ETFs

Short 30 year bonds

Short IWM/QQQ/EEM/EZU/EWZ/EWW via puts

Single Name Exposures

Long DISH (upcoming early May investor day catalyst)

Long MP/LNG/NOG/CCJ/MOS/AGRO/FCX (various long commodity-related names/inflation hedges)

Long FRO/STNG (tankers that will benefit as storage plays in the oil storage world)

Long DBA (agriculture commodity ETF)

Long KEUA (European carbon credit exposure)

Short RIO/BHP/VALE (mining hedges)

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.

Why not just go long on miners that pay a dividend rather than an ETF that pays NOTHING? One thing it seems that you're immune to is that earning "ordinary income" rather than a long term capital gain is just fine. That tax considerations are of absolutely no value in your investing strategy. I suppose. Different strategies for different ages. The less money I give to this corrupt government, the better. We're collapsing in less than ten years anyway ala Venezuela.

The US$ is NOT overbought as long as we're raising interest rates faster than other G-7 countries. Respect the carry trade.

"On the flip side, and not surprisingly, I see various currencies signaling quite overbought, especially the euro and yen." What the hell? The yen is being sold for a reason and it's crashing against the dollar. Japan is reaching the end stages of unlimited printing and they've even begged the federal reserve to intervene to prevent their currency from collapsing. The yen is EXACTLY where we are going once we reverse the interest rate cycle (however long that might be).