Portfolio Update - Some Capitulation Observed. Reducing some exposures ahead of Fed Meeting

Our tactical signals are showing cross-asset consternation to an extreme. We are covering some risk off bets ahead of Wednesday but still remain underweight risk.

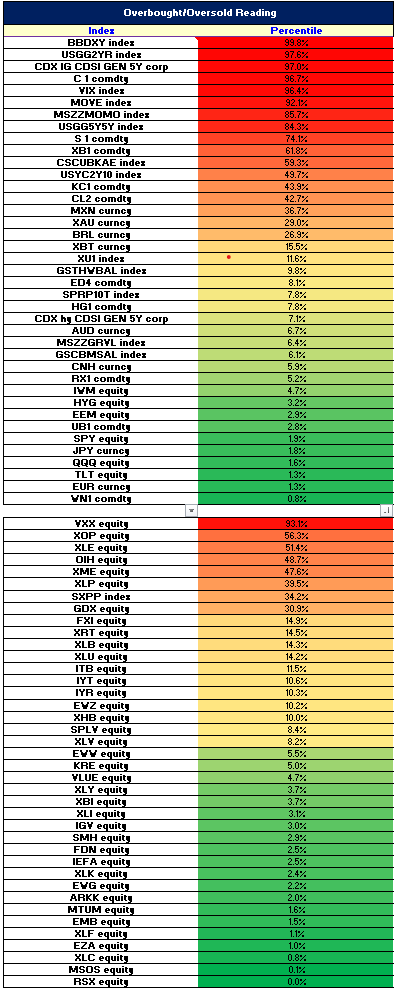

I introduced my overbought/oversold dashboard in last week’s post and mentioned that “I will continue to watch this dashboard closely. I expect to remain with the risk-off portfolio that I have shared with you at least through the May Fed meeting next week but will watch for signs of exhaustion to tactically reduce positions into the event if the moves I am expecting take place ahead of the Fed.”

Based on the price action last week, we are seeing signs of capitulation across various asset classes right now which necessitates us taking down some exposures into Wednesday’s event. Here is the updated scorecard:

We can see here that the DXY is very close to a 100% maximum overbought reading while 2-year yields, credit spreads, and the VIX are also quite overbought. Similarly, nearly all major equity and bond indices are screening quite oversold based on our metrics. Clearly, the market has been tightening financial conditions ahead of the Fed as expected so we are raising the bar too high for the Fed to out hawk the markets this time around even though ultimately that is what we have been saying they need to do. I must respect the price action that I am seeing and I will be taking down some gross exposures ahead of Wednesday’s meeting.

Fundamentally, I continue to believe that the key here for the Fed is USGG5y5y which is their preferred measure of inflation expectations. The Fed can say that they have tightened financial conditions thus far and they can say that the market has helped them along the way but with 5y5y closing at a monthly high, there is no way they can say that they have done enough or that the market is pricing in enough tightening. So despite the fact that equities are lower, credit spreads are wider, the $ is stronger and yields are higher, the Fed still hasn’t been able to remove entrenched inflation expectations from the public narrative. And given this, they will be forced to continue to be hawkish until the market begins to tighten financial conditions enough to bring down 5y5y inflation expectations. We will remain with the risk-off playbook until the Fed completes its mission.

Updated Positioning: No changes in structural ideas. Simply reducing position sizes in short equity and bond ETFs that have been working quite nicely into the Wednesday Fed meeting.

Macro Ideas

Long gold and gold miners via GDX

Long crude calls

Long Bitcoin

Short bank ETFs

Short 30 year bonds

Short IWM/QQQ/EEM/EZU/EWZ/EWW via puts

Single Name Exposures

Long DISH (upcoming early May investor day catalyst)

Long MP/LNG/NOG/CCJ/MOS/AGRO/FCX (various long commodity-related names/inflation hedges)

Long FRO/STNG (tankers that will benefit as storage plays in the oil storage world)

Long DBA (agriculture commodity ETF)

Long KEUA (European carbon credit exposure)

Short RIO/BHP/VALE (mining hedges)

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.