Quick Oil to Gold Ratio Math

Sorry for the headache but Russia seeking to price its energy exports in gold has the potential to be highly disruptive for global currency markets. Let's go through the math

We have been discussing for weeks our view that Russia and China together are seeking to reduce the power of the United States in global affairs and have been engaging in economic warfare tactics to weaken the global hegemon, attempting to create a new world order where the US$ no longer serves at the center. Russia has weaponized its energy resources while China has weaponized its control over the supply chain to starve the West from critical resources leading to rising inflation that is increasingly becoming difficult for western citizens to handle. This dynamic is forcing global central banks to begin monetary policy tightening agendas in an attempt to slow down the inflation before it runs away. This has kicked off a cycle of rising interest rates and/or weakening currencies as various central banks are dealing with this dynamic in differing ways. The global economy is in a precarious condition.

We have also discussed that the US and its allies ratcheted up the economic warfare last month with the decision to freeze Russia’s central bank overseas reserves, an event we believe will be remembered for decades as lighting the match that accelerated the US$’ ultimate demise. We have said that the events of 2/26/22 have likely ended the Petrodollar System in a manner similar to how Nixon removing the gold backing of the US$ ended the Bretton Woods System. Foreign central banks with the knowledge that their overseas reserves can be frozen or expropriated will increasingly be looking for alternative solutions to store their excess trade wealth as there is now legitimate fear that becoming an unfriendly actor in the eyes of the US government could lead to loss of precious accumulated reserves.

Part of the pushback we hear regarding our view is that there is other place for foreigners to store their wealth away from the US$. The TINA dynamic is in full effect. We understand these concerns and acknowledge that the US$ has continued to gain strength against most other fiat currencies over the last several weeks since this decision was made. That being said, we are starting to see early signs that an alternative system is being put into place, with gold and oil at the center of the system. Russia, in response to the actions of the West, has discussed they will begin to price their energy (and possibly other natural and agricultural resources) in Gold terms. As a result, I wanted to start to walk through some of the math regarding how this may place out and have a playbook in place as they accelerate the timeline toward the implementation of this plan. Full disclosure: thinking about pricing of commodities in Gold terms rather than in US$ terms has given me countless headaches. But once you start to see it, you can begin to understand why Russia wants to go down this path and why its likely that other countries would be interested in this alternative reserve system over time as well.

Russia is a tremendous energy exporter, both in oil and natural gas. We are going to focus on oil here for simplicity sake but I believe it is likely that Russia will move to start pricing all over its exports in gold terms over time.

Russia has stated that they will buy gold in the domestic market at 5,000 Rubles per gram. There are 31.103 grams of gold in a troy ounce of gold. So, Russia’s central bank will pay Rub 155,515 (5000*31.103) for an ounce of gold. The immediate response of this announcement was that this is not a great price for the gold given the current price of gold at $1915/oz because that would mean that the RUB/$ exchange ratio is closer to 81.2 (155,515/1915) vs. the current RUB/$ ratio that is to 90 (although was as high as 120). Russia is saying that its currency is stronger than the market is pricing it. We can either choose to believe that or not. There are limited arbitrage opportunities here at this point given the sanctions situation but truth is, we think this is only step one of Russia’s plan to support their currency. Interestingly, since making this announcement, the RUB has continued to appreciate again off its weakest levels. Markets are starting to notice.

The next, and more important step, is figuring out how much they are going to charge for a barrel of oil in gold terms. Once we have that piece of information, we will be able to have a better idea how prices and arb trades will move.

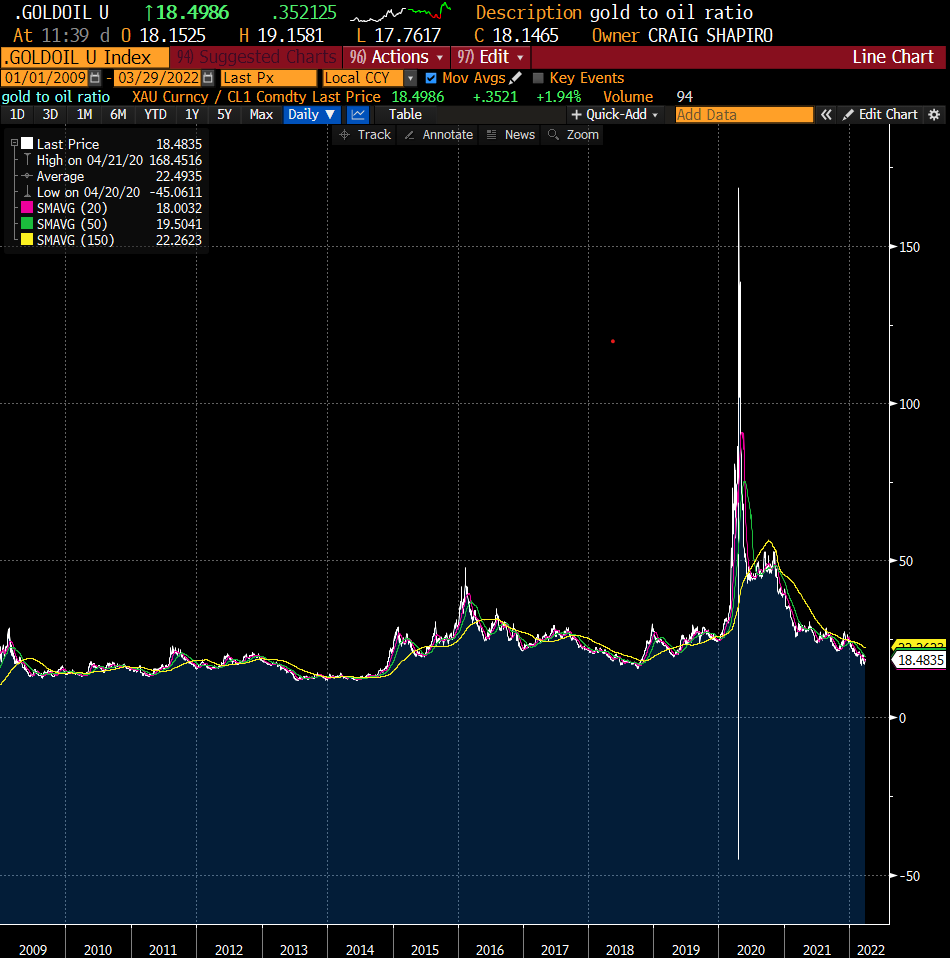

Below is the historical oil to gold ratio in US$. Currently, an ounce of gold can buy about 18.5bbls of oil. This is about the average price oil has traded at in gold terms over the last 40 years, however we can see that in the last several months, this ratio has been falling mightily as the price of oil has been rising vs the price of gold. That means, in gold terms, oil producers are receiving less for their oil in the ground.

Source: Bloomberg Data

Since the end of the financial crisis, we can see that the oil to gold ratio has been higher, averaging about 22.5 bbls/oz since the beginning of 2009.

Source: Bloomberg Data

Another way to visualize this ratio is to look at the amount of grams of gold it takes to buy a barrel of oil. As stated above, there are 31.103 grams of gold in an ounce of gold. So, we can see in the chart below, it currently takes about 1.68grams of gold to buy a barrel of oil. One gram of gold in US$ terms today is worth $1915/31.103 = $61.57. Current price of oil about $103. So $103/61.57= 1.680 grams per barrel. The average price since the financial crisis was 1.58g/oil. Here is that in graph form.

Source: Bloomberg Data

Have a headache yet? Let’s keep going. The next phase of this analysis is to determine at what price Russia will look to price their oil in gold terms. The current price of oil in gold terms is 1.68g/bbl. We have said above that this price is low vs history. We know that Russia is pricing gold at Rub5000/gram of gold. Let’s say that they price the oil at 1.5g/bbl:

1 oz gold = 31.103g gold / 1.5 g per bbl = 20.735 bbls of oil per oz of gold

The cost of 1oz gold as stated above is Rub 155,515

Current price of oil is $103/bbl. So, 20.735bbls * $103 = $2,136/oz vs $1915/oz today

Let’s say instead of 1.5g/bbl, Russia decides to price their oil at 1g/bbl:

1 oz gold = 31.103g gold / 1g per bbl = 31.103 bbls of oil per oz of gold

The cost of 1 oz gold as stated above is Rub 155,515

Current price of oil is $103/bbl. So, 31.103 bbls * $103 = $3,203/oz vs $1915/oz today

Here is another way to think about it. What does the gold price of today assume about the value of oil if we assume 1g of gold can buy 1bbl of oil?

1 oz gold = 31.103g gold/ 1g per bbl = 31.103 bbls of oil per oz of gold

Current price of gold per oz in US$ is $1915 so $1915/31.103 = $61.57/bbl of oil vs $103/bbl today.

So, if you are an overseas buyer of oil, a tremendous arb opportunity has opened itself up here. If Russia prices its oil at 1bbl=1g gold, a foreign buyer could buy physical gold today at $1915 and send it to Russia for a bbl of oil at $61.57/bbl cost. They could think re-sell this barrel of oil immediately at $103, locking in a $40/bbl arb profit (before shipping, fees, taxes, etc). What do you suppose would happen as this arb is realize by more and more potential buyers? It is very likely that there will be a run on physical gold in order to continue to buy the discounted barrels of Russia oil either to use internally or to resell for a profit. As the gold price continues to rise, this will further harden the RUB value in FX markets, allowing Russia to use its stronger currency to buy goods that it needs for its domestic economy.

Now, clearly, all of the details aren’t totally worked out here yet and there are still various risks but as we are waiting for the list of Russian demands as it negotiates a peace treaty on Ukraine, be mindful that part of the demand is likely going to be the ability to sell its domestic oil/gas/commodities in gold terms. And when this happens, expect there to be a violent re-rating of the gold price as the world collectively comes to grips with the reality that the real value of a currency is its in ability to produce and trade things, rather than simply just to create money. We believe we are further along the path toward a multi-lateral currency regime with gold at the center than people realize. We will be looking for the next step from the Russia government regarding the gold price needed for sale of their commodities to determine if we are correct.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.

According to IBISWorld, the dollar value of E&P worldwide in 2021 was about $2.1T. This excludes transport, refining and a lot more but $2T is only going to grow as our demand grows. (And yes, demand for hydrocarbons will grow at least for a few more decades.) VisualCapitalist.com has estimated the worlds total gold value at $12.5T in the fall of 2021 or closer to $13.5 T today. So just think about this relationship, one year of E&P vs total of worldwide gold. If this really happens, how will this impact the price of gold? Furthermore, while DXY remains strong for the time being, imagine the impact on the dollar.

Haven't heard much about this so many thanks Craig. Love your work.

Russia may peg gold to oil, but not many markets willing to buy it anyways besides Chindia - which looks like alternate sanctions will affect those two countries - further alienating Russia. Also, TPTB won't allow Russia to exit this because they NEED the bear to strike back so they can blame our economy's demise on them - so expect them to push max pain on to Russia. Only way to do that is hike interest rates and send paper gold down hoping market participants will liquify their gold holdings and cause a cascading ripple effect.