1987 Black Monday Redux?

PTJ's classic interview after the close on Black Monday is worth re-listening to. History may not repeat but it sometimes rhymes. Monday could be a washout.

As if this week’s trading and risk off action didn’t scare markets enough, I am reminded of the great October 1987 interview with Paul Tudor Jones on the conditions that were in place going into the weekend before Black Monday October 19, 1987. There are some scary analogs to those conditions being seen over the past few weeks which culminated in another strong market sell-off today. Jones discusses the following conditions which were evident to him on the Friday before Black Monday:

Range Expansion

Record Volume

Record Nominal Down Day

Close below the 200d Moving Average (not discussed specifically in this interview but was mentioned by him in his Trader documentary as part of his bear thesis then")

Overvaluation in markets for some time with piercing of a bubble in days leading up to the selloff

Wall Street unprepared for the magnitude of a drop

How does this set of conditions compare with the current environment?

Condition 1 has been met, volatility has been rising for weeks now. Intraday swings are sizable and PnL pain is definitely around.

Condition 2 wasn’t met today per se but there was massive volume on the tape given today’s options expiry and rolling off of over $3trn in notional open interest that was around to start the week according to Spot Gamma.

Condition 3 was not met even with the tough performance on Friday but for the month, the Nasdaq is already down over 10% and SPX around 7%. It is clear that market pain is around.

Condition 4 has been met and the close below the 200d MA for both SPX and NQ at the end of the week suggests that the primary uptrend for stocks has likely been broken.

Condition 5 has been met as valuation concerns have been in place for months now.

Finally, Condition 6 has also been met. While they has been more hedges in place lately and sentiment has been deteriorating, it seems like the market is implicitly still believing in a Fed put that is struck at the 200d MA. It’s likely this psyche is now breaking down. And the pain in some very large cap stocks over the last few weeks (like NFLX, SHOP, AMZN, etc.) is creating more angst about holding big names into the major earnings events next week.

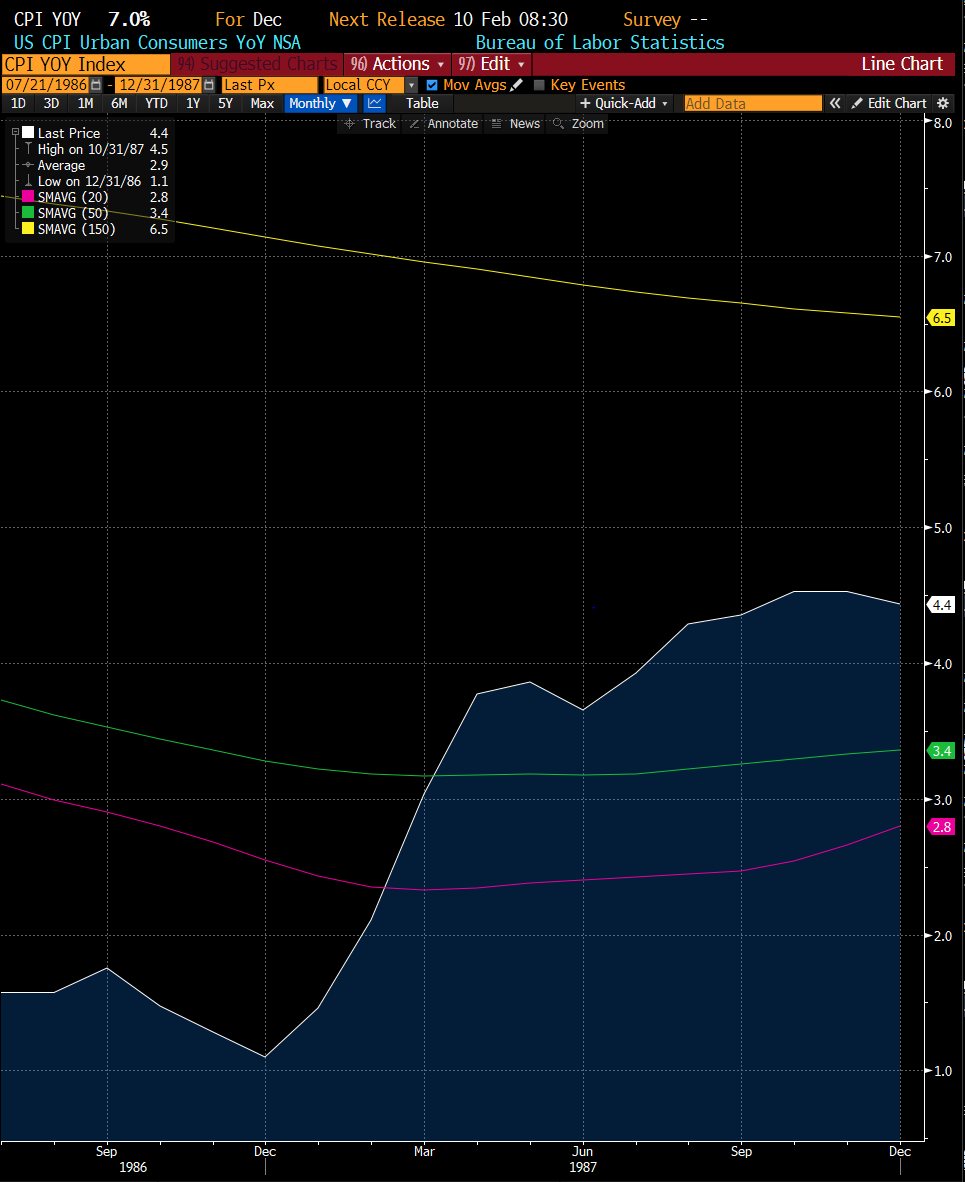

If we think about other conditions in place leading up to the 1987 crash, for starters we had a sizable runup in inflation throughout 1987 similar to what we have seen in the US over the last year or so. Inflation fears running through the economy that led to a rise in interest rates to slow demand were part of the worries for the market in the fall of 1987. A similar construct is in place today.

On back of this run-up in inflation, we had a large move higher in interest rates for much of the 2Q/3Q period of 1987, similar to the dynamic that has been place in the US over the course of the last 6 months. Although the order of magnitude increases and absolute levels in yields then vs. now are strikingly different, debt levels in the US are materially higher now vs. then and the economy’s ability to withstand higher yields is more challenged today than back then. So it’s more about the rate of change pickup in yields today that is analogous to what we saw back in 1987.

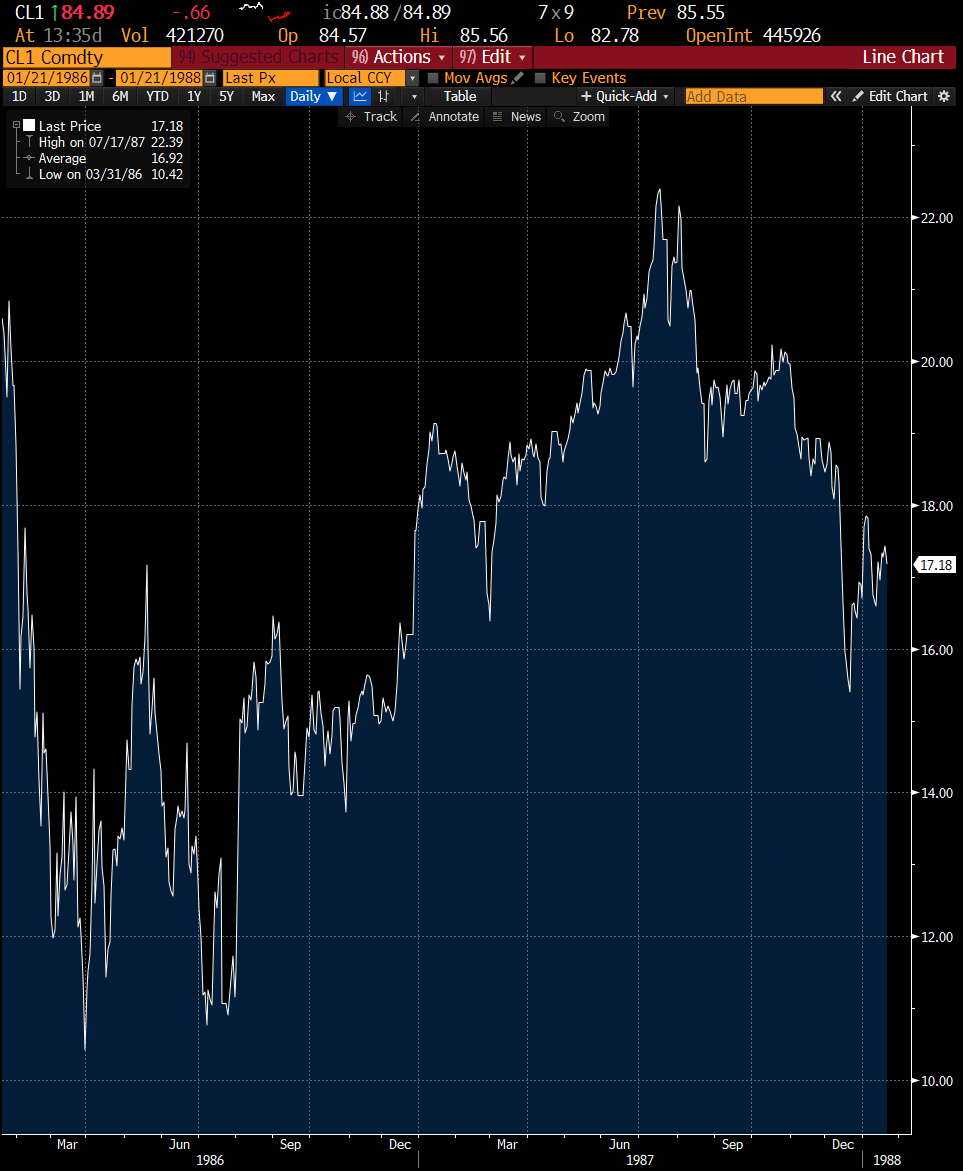

Part of that rise in inflation back then was due to rising oil prices as rising geopolitical concerns were still top of mind in the summer of 1987 similar to now with Russia / Ukraine dynamics front and center. Again, although absolute levels of oil prices are materially different now vs then, rate of change increases in the oil price became a concern for investors. Rising oil prices act as a tax on the consumer wallet and become a headwind for growth.

What Tudor discusses in the short interview is the idea of a liquidity vacuum in the markets that developed which led to capitulation selling of assets on back of rapidly tightening financial conditions. Part of the story back then was the idea of portfolio insurance leading to forced selling in order to hedge portfolios, a dynamic that is not in place today however one that has arguably been replaced by the explosion in daily options activity and negative gamma dynamics which can often lead to further selling begetting even more selling when markets spiral down. We have continued to warn that the Fed’s tightening of financial conditions to arrest inflation gains was something that would be a significant headwind for risk assets to start 2022. We have been seeing this dynamic play out in a big way over the last several weeks. Today was another example of that concern.

Is Monday January 24th going to be a Black Monday redux? Probably not but eerie the similarities and the possibility has put us into some crash index puts just in case. There are obviously many other differences between now and then which would suggest this analysis is just a fool’s errand. Regardless, the thought process was worth going through. And as discussed in our earlier note today, we will be using any further weakness on Monday to cover some shorts and look to re-enter higher as we believe the primary trend for now is lower for risk.

Enjoy the video. Enjoy the weekend. Trade carefully.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.