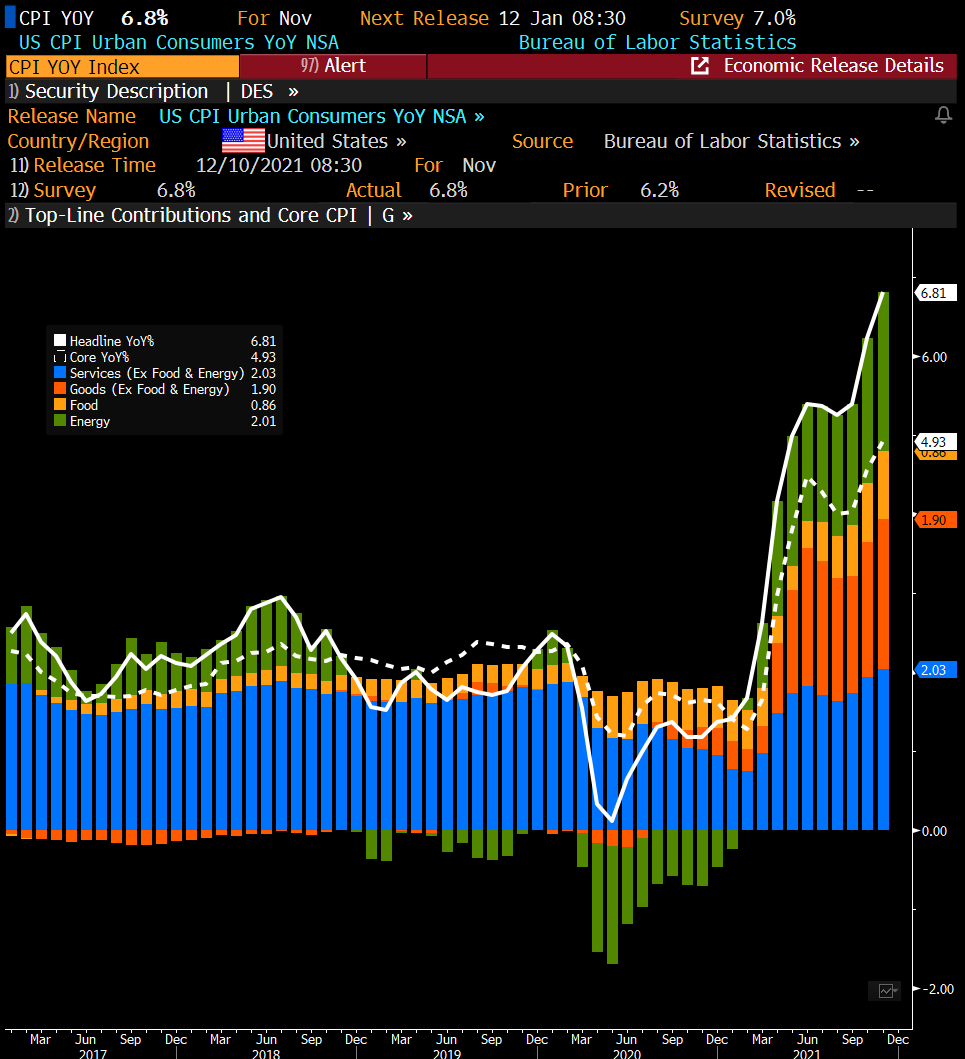

CP-Aye-Yai-Yai

Tomorrow's CPI will dictate the market narrative for the next couple weeks into the January Fed meeting.

We thought Powell’s testimony today would continue the hawkish messaging that we were hearing from countless Fed members over the last few weeks, including this morning from Mester, George and Bostic, all of whom seemed to favor March hikes and a beginning of the QT/Balance sheet reduction process soon thereafter. However, while being given ample opportunity to continue pushing along the hawkish narrative in further attempt to prevent rising inflation expectations from become “entrenched,” Powell “whiffed”, instead choosing to slow play the onset of tightening, carefully choosing his words to make sure he didn’t get too far ahead of the committee about the timeline to financial condition tightening.

When given this same opportunity last month, he took the bait and queued up the acceleration of the tapering that we saw at the December meeting, which kicked off the bond market selloff that we have been seeing at the front end for several weeks now. This time around, however, he decided to not push that agenda further along and this decision needs to be respected. Perhaps he was waiting for tomorrow’s all important CPI print before deciding to get more hawkish; perhaps he wanted to be dovish so that Brainard could sound more hawkish in her testimony coming later this week and assist her confirmation process by painting her as more hawkish than he is. Whatever the reason, he wasn’t as hawkish as the market feared and thus, risk assets are responding accordingly with a rally in bonds, stocks, crypto, commodities and credit as the timeline to tightening of financial conditions has theoretically been pushed back.

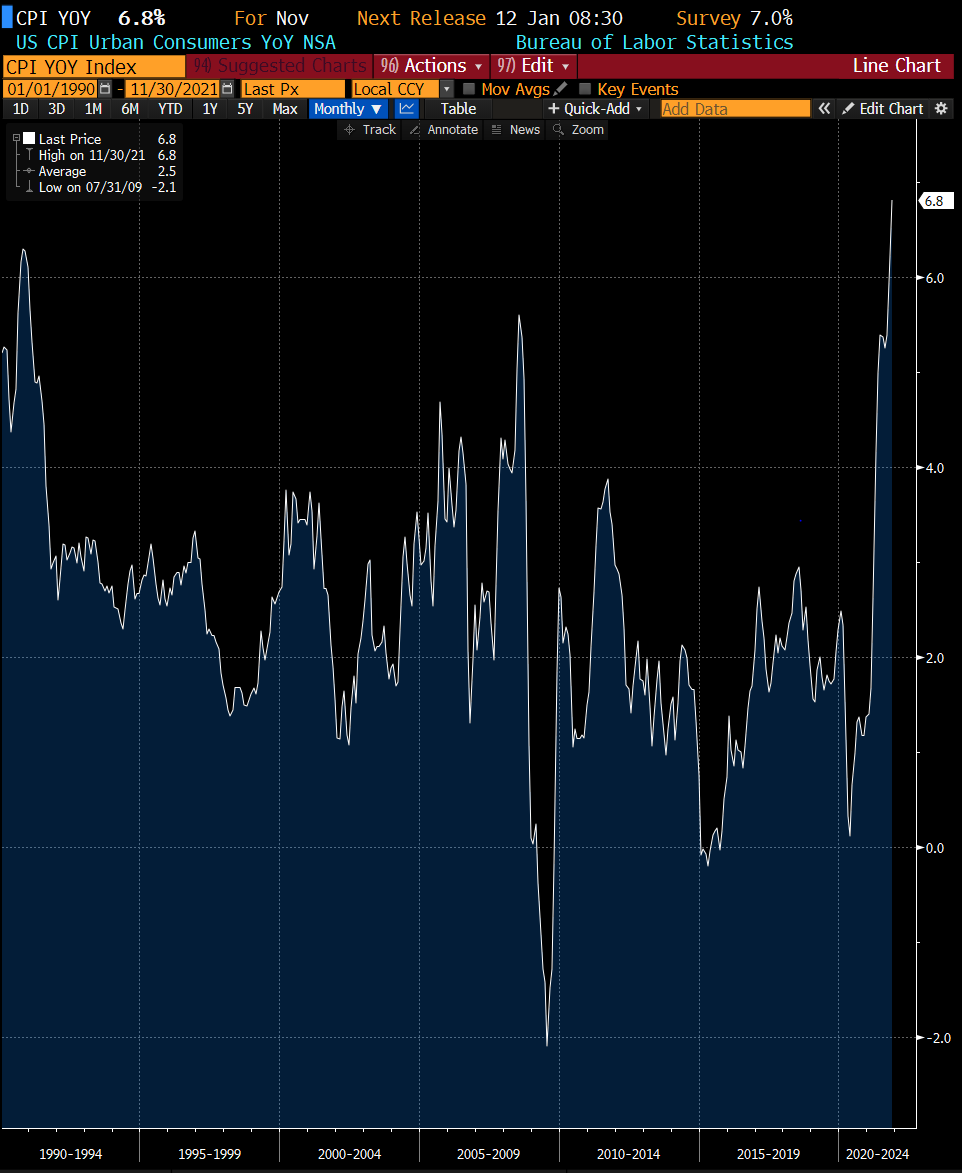

That leaves us with tomorrow’s all important CPI print. The street is looking for a 7%+ figure and 5.4% for core CPI ex-food and energy, both of which would be cycle highs and historically elevated readings when looking back over the last 30+ years. So we know that a hot reading is expected and Powell did say today that the Fed needs to prevent runaway inflation to ensure the prospects for a longer expansion which will be necessary this time to really achieve maximum employment given some of the structural changes in the labor market caused by the pandemic. My bias is that we do see confirmation of a scary hot print tomorrow and that re-introduces risk into the January Fed meeting with the Fed needing to get more aggressive on tightening. However, the flip side is that a softer than expected print would likely lead to another fierce risk-on rally, as it would give more credence to the idea that the Fed can slow play the tightening agenda (end tapering in March, first rate hike March/April, start QT in June/July) rather than being forced to push this entire agenda forward with a guaranteed rate hike in March and likely beginning of QT in April.

Source: Bloomberg Data

Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risk so do you own due diligence.