Dolla Dolla Bill Y'all

Keep an eye on surging US$ as potential catalyst for the next risk-off episode. Carefully watch $/cnh for a move higher to help stymie commodity market momentum

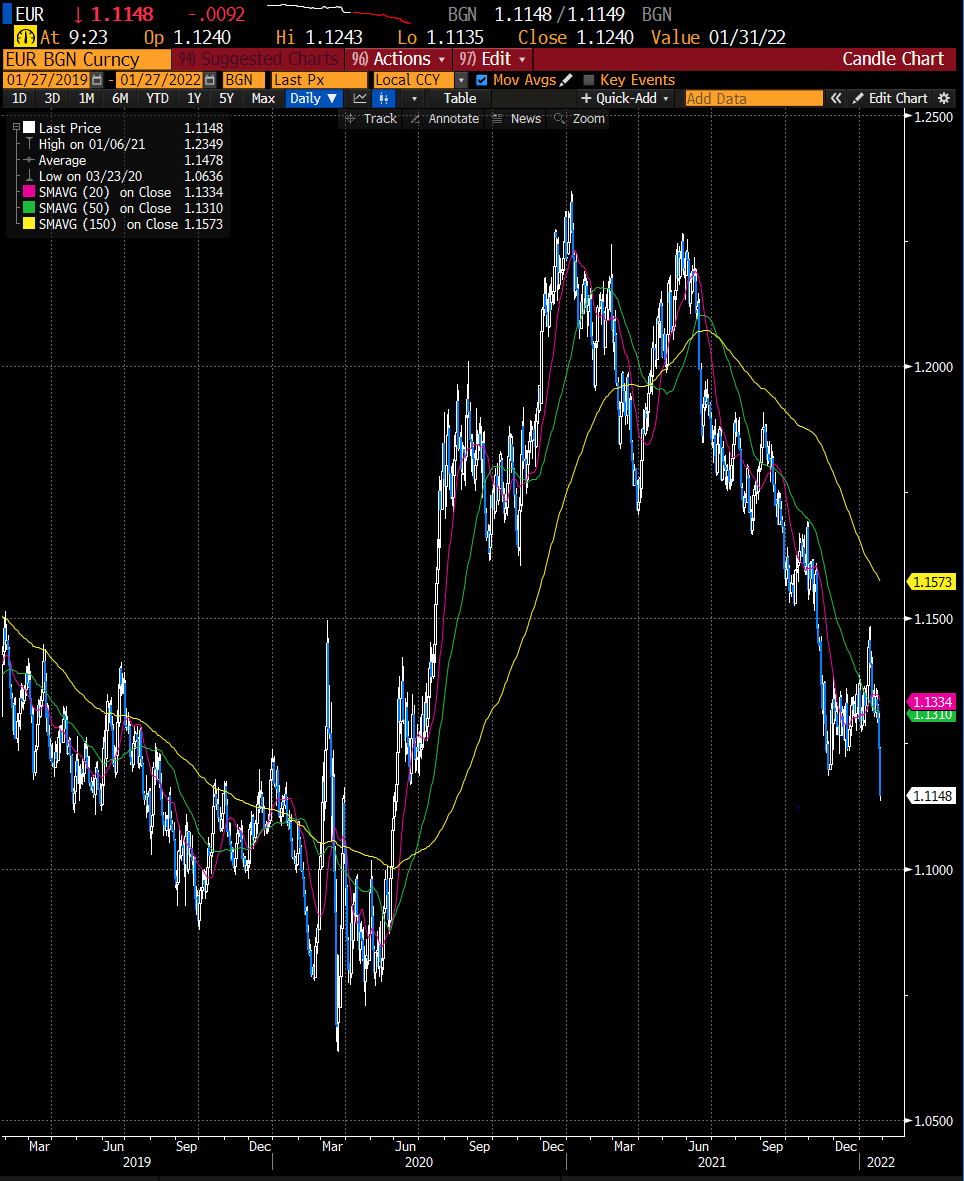

Just wanted to quickly point out that post the Fed meeting yesterday, where Powell reiterated the Fed’s intentions to normalize monetary policy in order to prevent inflation from becoming more entrenched in society, we have seen a nice breakout higher in the US$. The US central bank is ending asset purchases, threatening to raise rates several times this year, is open to the possibility of even greater than 25bps hikes, is possibly raising at consecutive meetings and will be reducing the size of its balance sheet in the second quarter. When the Fed gets to tightening, the FX markets tend to wake up. The US$ is starting to break-out and normally, when the $ rallies, things start to break. Watch out for the US$ wrecking ball as another headwind for risk assets.

DXY

Euro

And most interesting for me, where further pain could be realized, would be if the $ vs CNH could start to rally. Typically, when $/cnh starts to rally, commodities come under pressure. This could start to remove some of the inflationary impulse out of markets but given positioning long into energy and reflation trades, this would be another source of Pnl pain for investors. It is still early days for this move after significant underperformance over the last two years but we are seeing some interesting positive divergences on the charts and last night 3+ standard deviation move has us awakened.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.