Fed's Updated Scorecard: From "NI" To "S"

With the strong move lower in risk assets over the last ten days, we have upgraded the Fed's grade to "Satisfactory" in its task of removing elevated inflation expectations. We are covering some short

Last week, we had this to say about the Fed:

“The Fed is trying hard to lower inflation expectations. How are they doing? The scorecard so far says their grade is “Needs Improvement.” One way to score them is to look at market based pricing of forward inflation. The Fed’s preferred metric to evaluate this is looking at 5 year inflation expectations 5 years from now (USGG5y5y). We can see from the chart that while these yields are off the highs, they still remain reasonably above the average (1.95%) we have seen since 2015 and at 2.18% currently, they are well above 2% target. We think the Fed views its definition of success as seeing this metric fall back down toward 2%.”

Well, fast forward 10 days and here is the updated chart now:

Source: Bloomberg Data

Through its jawboning over the last several weeks, the Fed has been able to remove some heightened long-term expectations from the market mindset. USGG5y5y yields (which are 5 year forward inflation expectations assumed 5 years in the future) have moved back down below 2%, a level we think is important for the Fed given their price stability mandate centers around the 2% target. Along this move lower, there has been a fair bit of equity market pain, which is what we had expected to happen. While we believe there are plenty of reasons for the Fed to remain hawkish and we fully expect them to continue that rhetoric next week, from a trading perspective, one of the tools that I have used to allow me to remain quite bearish has moved from a “Green “ light back to a “Yellow” light. So, I will be looking at taking some short exposures off over the next two trading days ahead of the Fed meeting next Wednesday where the risk that they talk back some of their overt hawkishness has moved from very close to 0% to something a little bit higher.

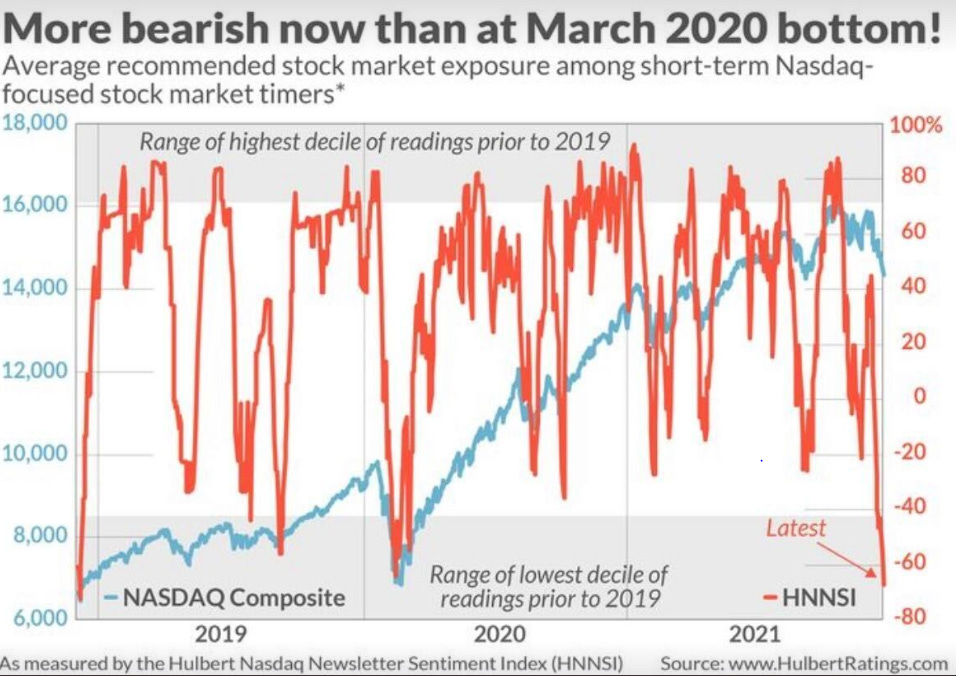

When trading a downturn, we need to respect the sentiment and momentum ranges. I think we could be reaching a near-term crescendo on the downside so I want to be in position to make good covers now and then re-engage on the short side on future rallies. Sentiment indexes are starting to flash oversold. We note this metric from Hulbert out this morning:

Source: www.hulbertratings.com

While still extraordinarily loose by historical metrics, financial conditions as measured by the GS Financial conditions index have made a 52 week high, another dynamic that needs to be respected when trading the short side of the downtrend. The Fed wants to tighten financial conditions but the rate of change of that tightening is important to them as well. If conditions tighten too rapidly, the Fed is more likely to back off. We don’t think we are there yet but a quick move tighter the week before the Fed meeting is likely to grab their attention.

Source: GS and Bloomberg Data

All in all, we still find many reasons to be negative about the outlook for risk assets in the coming weeks/months as the Fed needs to further tighten financial conditions to remove entrenched inflation expectations from the societal psyche. We think this process plays out over 2022 and want to be positioned accordingly throughout the year. But from a near term perspective, when two of our traffic lights to be negative have moved from “Green” back to “Yellow,” we are wise to take some profits on short side on weakness we have seen.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risk so do you own due diligence.