For all the tea in China

Since the US is acting like an emerging market, the $ is starting to be treated like an EM currency.

Here is what I wrote in my prior post about the US and its inability to get inflation under control:

“A central bank that cannot control its inflation sees its currency weaker. That’s how an Emerging Market would trade. The more the US$ continues to lose its share of global transactions and thus its hegemony status, especially in the pricing of commodities (particularly oil), the quicker this change will happen.”

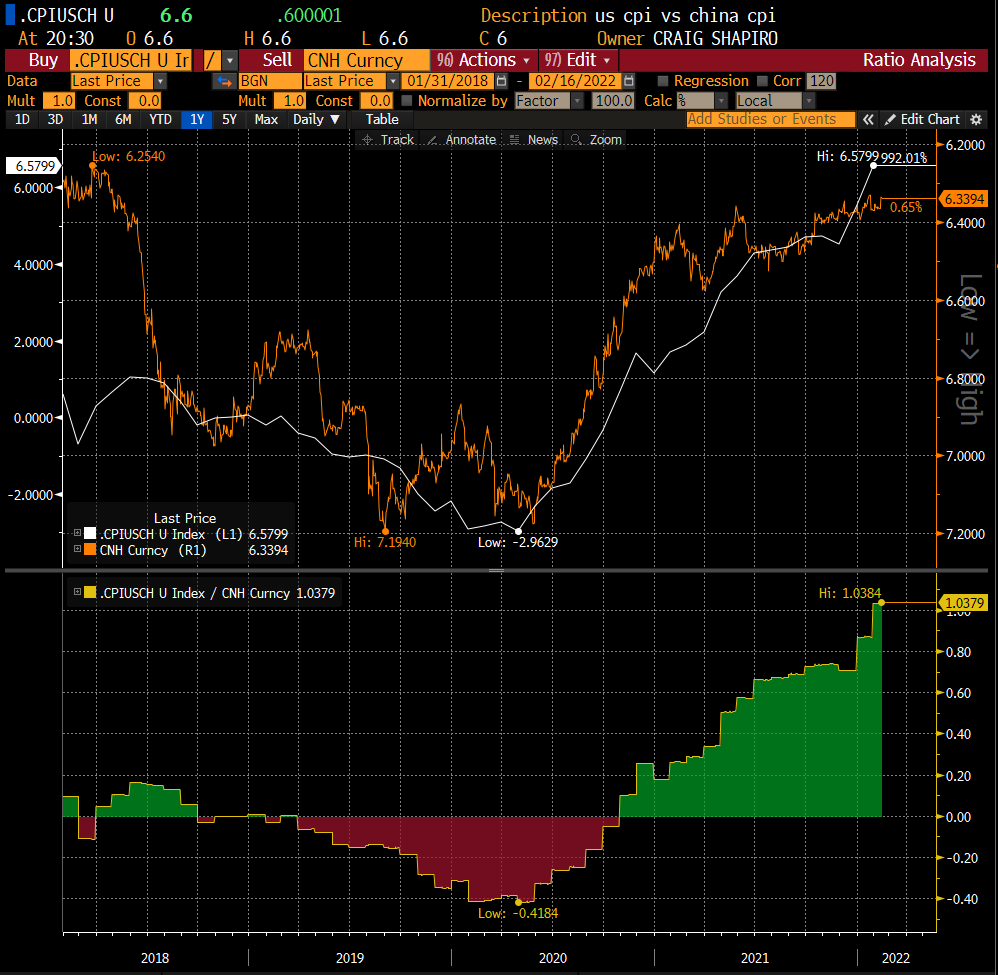

I found this chart below to be a fascinating reflection of this current reality and it fits well within the dynamic I think is at play between Russia and China and their desire to work toward the end of $ as the world’s exclusive reserve currency. We can see the white line reflects the difference between US and China’s CPI since the beginning of 2018, which is when China started to trade some oil for RMB and listed oil contracts on the Shanghai International Energy Exchange. The orange line is the $/CNH rate (inverted) which means the rising line is the $ weakening against the CNH.

Source: Bloomberg Data

The US, running a massive current account deficit with its enormously growing government debt as % of GDP, is experiencing inflation at an accelerated speed and is doing very little about it. This is the type of behavior we normally would see out of countries like Argentina, Turkey, Brazil, etc. Classic emerging markets who behave this way see their currency weaken and their sovereign bonds sell off (higher interest rates) as capital begins to flow out of the country due to fears of investor loss stemming from this inflation. In order to keep the capital in country, the central bank needs to tighten policy, raise interest rates and make it more attractive for capital to stay.

With China’s ability to purchase commodities, especially oil, in RMB, the US’ hegemonic control over world’s reserve currency is coming to an end. The $ continues to weaken against the CNH as inflation differentials between the two countries grow further and further apart. Until the Fed starts to get serious about arresting the inflationary pressures in the US, we suspect the $ is going to continue to weaken against hard assets, gold, the RMB, etc. And as we have discussed, if the Fed chooses to defend the US$ with higher interest rates, we are likely to experience a recession and market correction that possibly could kick off a debt crisis anyway as tax receipts would fall and exacerbate the government’s borrowing needs. Bad choices all around for the Fed and the Biden administration.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.