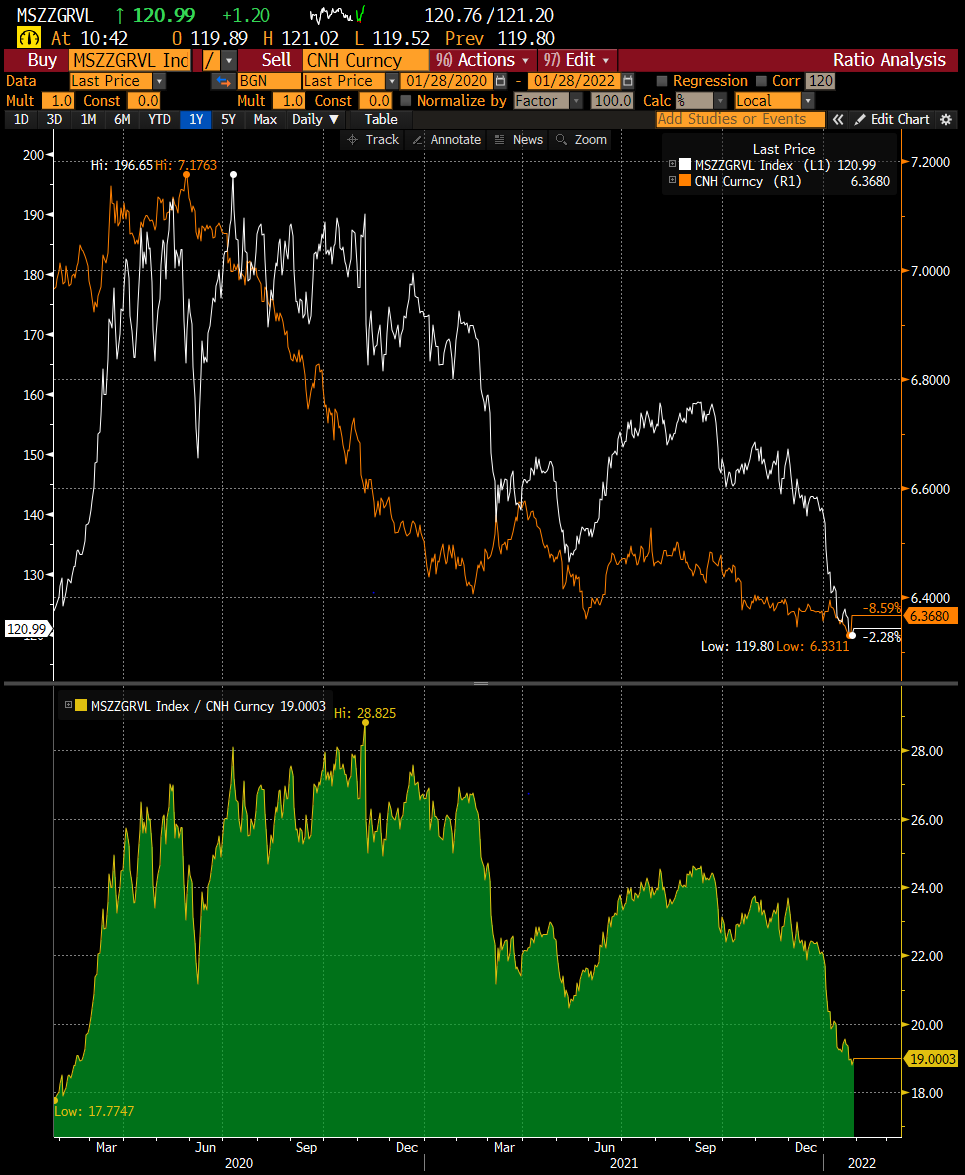

Has the Growth to Value Rotation has run its course? We Say Yes

As $/cnh finds a floor, expect value's outperformance vs growth to wane. Sell Value, Energy and Reflation trades

Fun chart here - Growth vs. value ratio vs $/CNH. My thesis is that as $/cnh starts to rally here on combination of diverging monetary policy and growth trajectories, this will start to become a headwind for reflation/value sectors as the Fed fights inflation more aggressively. We are starting to see some positive divergences on the growth to value charts off of very oversold levels. This makes me want to short value sectors if $/cnh can keep elevating here. I am not looking to get long growth on an absolute basis because I still think equities as an asset class will be pressured into tightening cycle. But at this point, I think the risk-reward suggests it is better to be shorting value, reflation, energy and small caps.

Source: Bloomberg Data

$/cnh - Trying to find a floor with some positive divergences on the charts

Source: Bloomberg Data

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.