Is Powell going to be Biden's Volcker?

Biden says it's appropriate for Fed to "recalibrate" support as needed. A hawkish Admin with a hawkish Fed is not a great combo for risk assets

It is pretty amazing to think how far we have come from President Trump who hated the prospect of interest rate hikes because of his fears (correctly) they would disrupt the stock market to now President Biden actually encouraging interest rate hikes in order to prevent inflation from becoming entrenched in the societal psyche. Clearly, with inflation running at a 7+ handle and unemployment trending sub 4%, things are different now under Biden than Trump but this shift in DC regarding the role of monetary policy to stymie inflation over supporting growth needs to be respected.

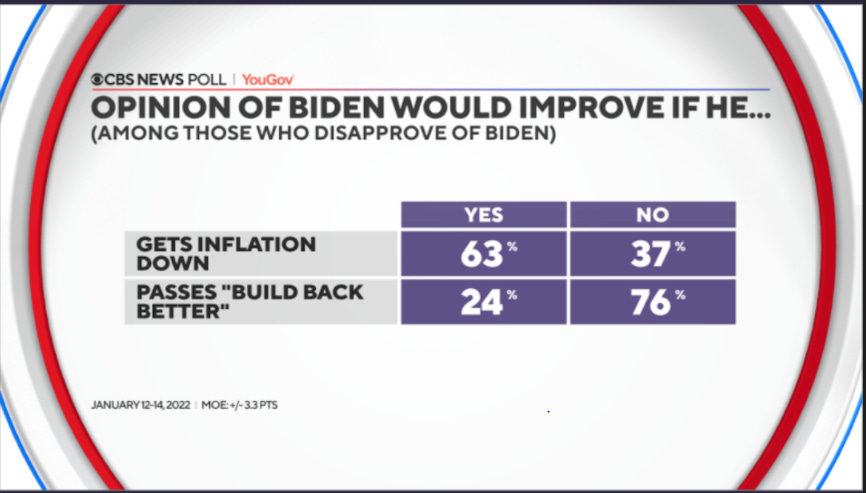

Biden is making a bet that arresting inflation will help him at the polls (where he has been failing mightily) however the tightening cycle is likely to cause a significant risk asset price correction too. As we have discussed, polling data is telling him that he better get inflation under control sooner rather than later if there is any hope for Democrats at the midterms this fall.

The question will be whether the feedback loop from lower risk markets that stems from a monetary tightening cycle ultimately leads to an economic slowdown that slows the labor/wage gain momentum which is currently being achieved by lower and middle class workers (aka the brunt of his voter support). Historically, significant asset price corrections have had a negative feedback toward slower growth and employment, something that would likely harm Democrat election prospects at midterms if it were to be top of mind this November.

So is this time different? Biden is making the bet that it will be, that structural dynamism in the underlying US economy (driven by new technology, renewable energy, infrastructure, etc.) likely aided by demographic trends keeping the labor market snug will allow for a more sustainable economy as we enter election season. The jury is out. We are not so sure but first things first: A hawkish Fed being supported by a hawkish Administration whose primary goal is to prevent inflation expectations from further becoming entrenched in society seems to me to be a toxic combination for risk assets in coming weeks/months.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risk so do you own due diligence.