The Fed's Current Grade is "NI"

As the kids approach midterms this week in Florida, we give the Fed a grade of "NI" on its task of removing elevated inflation expectations.

We suspect Powell’s re-nomination by Biden was conditioned on him convincing the President that he would be able to help remove the fear of runaway inflation from the market, something Biden was keen to have happen in light of his failing polling data, much of which has to do with societal fears about inflation, blaming the administration for their handling of prices.

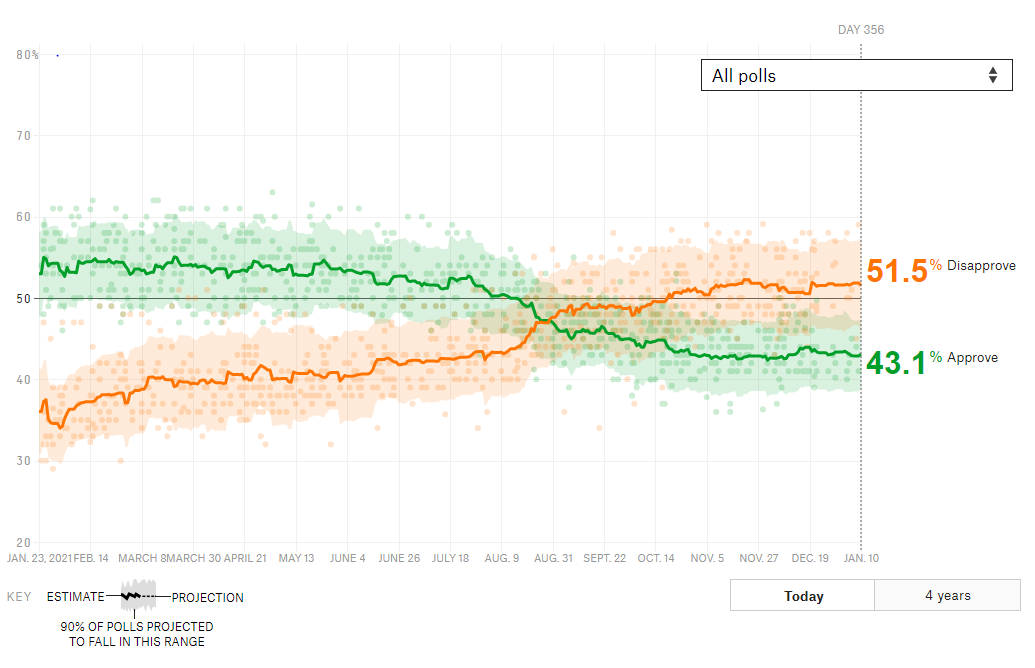

Biden’s Approval Rating:

Source: https://projects.fivethirtyeight.com/biden-approval-rating/

Although not the only factor, the correlation of Biden’s approval ratings with CPI readings (inverted on chart) is pretty clear: Higher inflation is bad for the President (and for Democrats hopes at the midterms).

Source: Bloomberg and Real Clear Politics Data

As a result, Chair Powell has been tasked to help this inflation fight, which is part of the reason we have seen such an aggressive “hawkish pivot” by the Fed chair over the last several weeks, with an acceleration of the tapering timeline, the pricing in of a more aggressive rate hiking cycle and talks of the beginning of QT which would remove liquidity by reducing the size of the Fed’s balance sheet. Discussion of these items were non-existent 9-12 months ago but all of a sudden, they are front and center in investor minds.

The Fed is trying hard to lower inflation expectations. How are they doing? The scorecard so far says their grade is “Needs Improvement.” One way to score them is to look at market based pricing of forward inflation. The Fed’s preferred metric to evaluate this is looking at 5 year inflation expectations 5 years from now (USGG5y5y). We can see from the chart that while these yields are off the highs, they still remain reasonably above the average (1.95%) we have seen since 2015 and at 2.18% currently, they are well above 2% target. We think the Fed views its definition of success as seeing this metric fall back down toward 2%.

Source - Bloomberg Data

Another metric market participants use is 10 year breakeven yields (USGGBE10). Based on this metric, we can also see the Fed’s work needs improvement. We look at a shorter term chart here. Although also off the highs, we think success is starting to be achieved another 30bps lower from here, under the 2.2% level which would be the lows from last summer. They still have plenty of wood to chop to get there.

Source: Bloomberg Data

Powell speaks tomorrow. He will be peppered with questions from the right and left about inflation. We suspect the “Fed put” to shift back toward a neutral or dovish stance would only really be reached if the USGG5y5y 2% level was breached to the downside. We just aren’t there yet. So don’t expect the Fed “dovish pivot” until there is more evidence that they have actually achieved their goal of lowering inflation expectations. Expect him to hawk it up instead. Trade carefully as he does.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risk so do you own due diligence.