You Had One Job!

Export controls and resource procurement at any price are ushering in an inflationary cycle that the Fed fails to see. Keeping inflation expectations "well-anchored" was their only job. They failed.

Mexico is considering reducing oil exports to achieve self-sufficiency in fuels and stop selling oil abroad by 2023. China has asked state refiners to consider pausing exports of gasoline and diesel. Hungary has discussed banning agriculture exports. Russia export bans are coming for a variety of well-known reasons. Ukraine has also banned the export of wheat, oats and other staples for obvious reasons.

Notice a pattern here. Countries are prioritizing access to critical goods for their citizens over other agendas. And it is this idea that has created a major blind spot for the Fed. Their view that supply chain issues are temporary and the inflationary impacts are transitory is completely misplaced. Monetary policy can not force people to buy sanctioned Russian goods. Monetary policy can not force countries to sell energy and food abroad. The global flows for commodities are obstructed by a variety of factors that are simply out of the Fed’s control.

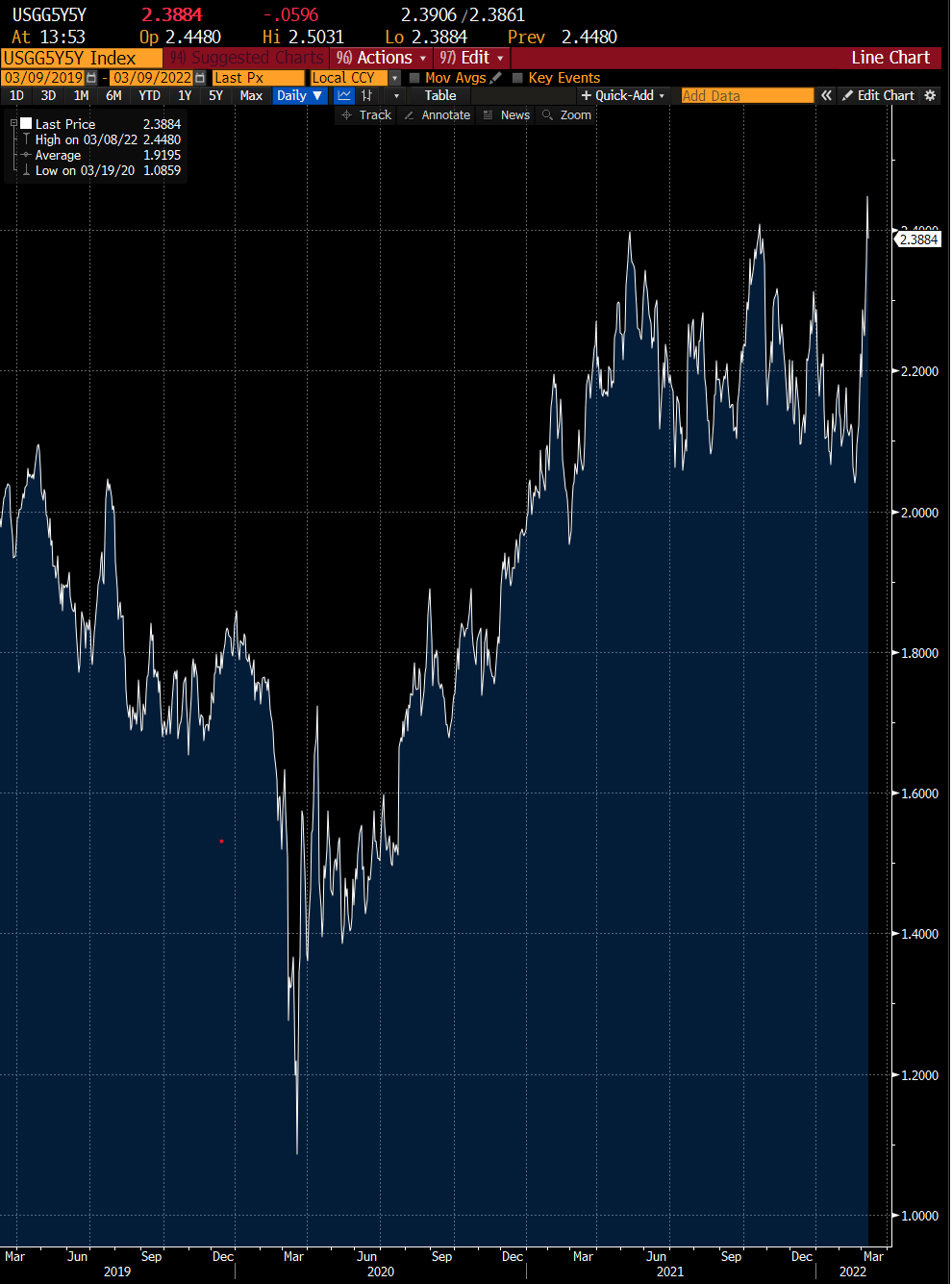

We are moving into a new world where procurement of critical resources by governments will be prioritized at any price. Their need to acquire goods without regard for price will exacerbate inflation globally. This will further embed itself into the psyche of citizens. The Fed's only real job was to prevent inflation expectations from becoming embedded in the public narrative and to keep inflation well-anchored. With breakeven yields breaking out to new highs, they are failing miserably. The Fed’s "power" to control inflation that stems from their communication tactics has become inept.

We favor a pro-inflation playbook as the Fed remains woefully behind the curve addressing this new economic world order. Sticky inflation will be with us for longer than expected. Until the Fed gets with the program, we continue to own commodities/hard assets/bitcoin. We are sellers of bonds. We favor value over growth.

*Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do you own due diligence.